STAFFORD – The local governing body was in session early Saturday, February 1, a move that initially raised eyebrows with some residents. Mayor Bob Henken explained that the Township Council had shifted its February 4 meeting date when they received notice that three council members could not attend that evening.

Hearings were conducted on two ordinances passed at the Saturday meeting. No one from the public offered commentary on the first ordinance. It passed unanimously, allowing the municipality to prepare its 2025 budget to exceed the budget appropriation limits and establish a cap bank.

Residents Demand Transparency

However, the second ordinance, 2025-02, drew public concern. This ordinance amended one passed last April concerning the revaluation of property. The amendment puts an additional $250,000 aside to pay for the reval, bringing the total to $1,250,000.

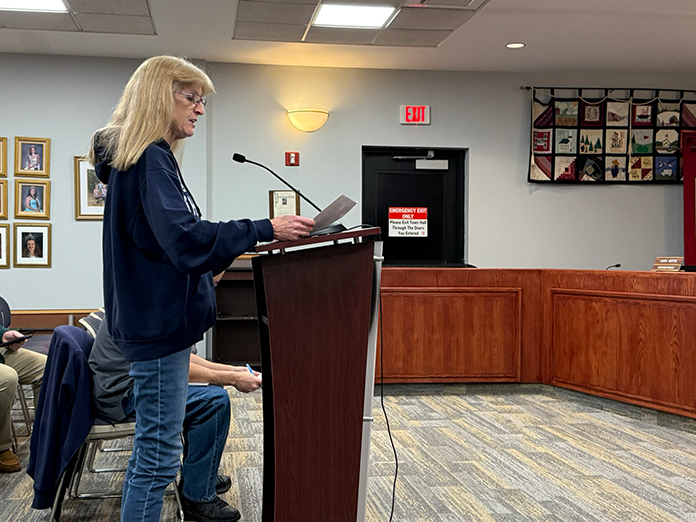

Resident Barbara Crystal described what she perceived as procedural and financial mishandling of the reassessment/revaluation process, which began on December 15, 2022. She accused township officials of misinforming residents and commencing the project without any notice.

“Residents were subjected to in-person property inspections on the morning after Election Day,” Crystal stated. “The notification letter from the tax assessor, which should have been sent out months before November 6, 2024, was posted on the township website and Facebook that night and received in the mail days after. So much for honesty, transparency, and keeping the residents properly informed.”

Hybrid Revaluation Approach

Towns are usually ordered by the state to do a revaluation when the actual sales of property are more than 15% of what the property is assessed for on your tax bills. A revaluation is when an outside company determines what each property is actually worth. A reassessment is the same thing, but done with town employees.

Stafford has taken a hybrid approach to handling the revaluation process. When the municipality put the project out to bid in the summer of 2023, only six companies were qualified to do the work. The township received no responses, presumably because the limited number of providers (now down to five) were otherwise engaged throughout the state.

“At that point, the Ocean County Board of Taxation, whom the municipalities in Ocean County report to, asked the municipalities to look into alternatives to comply with the State’s order,” said Township Administrator Matthew von der Hayden. “This is how it turned into the hybrid reassessment the Township is conducting.”

Tax Assessor Joe Mancini and Deputy Tax Assessor Christopher Hackett possess the necessary credentials for the process. Von der Hayden suggested Mancini come up with a proposal that would include awarding a contract to an outside vendor to conduct reassessment residential inspections. Professional Property Appraisers, Inc (PPA) was one of two entities that submitted a proposal and they were ultimately awarded the contract. Stafford executed the agreement with PPA on September 10, 2024.

Revaluation Cost Raises Questions

At the recent meeting, Crystal outlined her understanding of the original cost for the revaluation, which included allocations of $816,860 to PPA, $176,000 to the tax assessor, and $88,000 to the deputy tax assessor for a total of $1,080,860. The amount payable to Mancini in addition to his salary and benefits is listed as $131,803 in 2024. For Hackett, the amount is added to his township salary and benefits, which in 2024 was $77,775.

Crystal said that at the January meeting, she asked how the $250,000 increase needed for the ordinance was calculated and was advised of a December 20, 2024 memo from the township tax assessor stating that the per house, house inspection price had risen $20 from $40 to $60. She asked if that memo, or something similar, explaining that information could be posted. She was told no.

Former Councilman Paul Krier also spoke out against the proposed ordinance. He recalled the township receiving notification of the need for the revaluation back in 2022.

“It wasn’t unexpected, nor was it emergent,” said Krier. “The township chose to take no action at that time, even though a number of municipalities in Ocean County got right on it.”

Krier added his recollection that in September of 2023 the tax assessor exchanged an email with the president of PPA and received a rough estimate of a complete tax revaluation. Krier claimed the response was a “guess” of between $100 and $125 per unit. He further submitted that the $40 per unit price was a make-believe number with unsupported amounts for other items. Lastly, Krier addressed the additional compensation afforded to the tax assessor and deputy.

“We were under no obligation to pay them anything above and beyond their salary and compensation, because doing a revaluation or participating in a revaluation is fundamentally well within their duties prescribed by state law, by the code and by common sense,” Krier stated.

Township Attorney Lauren Staiger explained that it’s not uncommon for assessors to receive extra compensation whenever there’s a revaluation.

Aware that the Township of Ocean went through the process last year, The Southern Ocean Times checked with their Township Administrator Diane B. Ambrosio to learn how they handled it.

“Our assessor was authorized to do the revaluation,” said Ambrosio. “We decided it was better to pay him the extra compensation because he knows our town better than anyone else from the outside.”

Staiger said the reassessments or revaluations are different from the day-to-day operations normally undertaken by municipal assessors as part of their everyday job. She also pointed to a state statute and case law that speaks on the issue.

In Femminella v. Board of Trs., Pub. Employees’ Ret. Sys., the state appellate court said that “the tax assessor’s duties are set by statute, and an assessor is vested with quasi-judicial powers. Accordingly, a municipality does not have the power to order its tax assessor to take on additional duties, such as those associated with a revaluation.”

The Appeals Court acknowledged that such projects “require an immense amount of work” and that even if assessors could legally be assigned these duties, their workload would drastically increase.

Final Approval

Crystal maintained that the numbers are still inflated and don’t make sense regarding the additional money in the resolution. She added that local officials haven’t explained how they determined the amount to compensate the two township employees.

“Ordinance 2025-02 approved an increased project total appropriation of $1,250,000,” said Crystal. “This $250,000 increase included $166,000 of unspecified expenses contained in the amended proposed budget memo dated December 1, 2024.”

Crystal noted that the cost of “revaluation firm assistance” had increased from $526,000 to $816,860. She further pointed out a new line item allocating $100,000 for “Commercial Appraisal Review/Consult by Appraisal Expert,” comprised of four subsections, raising further questions about the justification and transparency of these costs.

“Will this be the final time that this project cost is increased?” Crystal continued. “Residents are struggling to pay monthly bills due to exorbitant utility costs, household expenses, insurance fees, food prices, etc… We truly need our governing body to make decisions in a fiscally responsible manner during these challenging times.”

Von der Hayden said the change in the estimate came from PPA and that the project was still being done at a cost savings of between $350,000 and $500,000. “If we privately did it, it would cost between $1.6 and $1.8 million,” he added.

The ordinance passed unanimously with no questions from the mayor or council members.