PLUMSTED– Township officials discussed further details about this year’s adopted spending plan during the latest Township Committee meeting.

Former Chief Financial Officer Sharon Gower returned to provide a PowerPoint presentation for those in attendance. The proposed municipal budget includes utilizing $250,000 in PILOT (Payment In Lieu Of Taxes) funds to balance the spending plan.

This is the first time PILOT funds derived from an agreement between the township and the developers of Lennar have been used for the municipal budget and there were some concerns expressed that this could create a revenue hole in next year’s budget.

A PILOT program, is a deal between a developer and a municipality. Instead of the developer paying property tax, it pays a set amount, which would be lower. It’s an incentive to get builders to work with towns.

Lennar’s PILOT program is for 30 years and for the first five years, the builder will pay a reduced rate based on taxes and then after year five, years six-30 will be at the regular rate. The development, Venue at Longview is located off Province Line Road.

Mayor Dominick Cuozzo and Committeeman Robert Bowen disagreed over the use of PILOT funds fueling this year’s spending plan.

Committeeman Bowen voted against the budget’s introduction in May which totals $6,865,095.39 and the amount to be raised by taxes at $2,491,032.31.

Mayor Cuozzo said “our budget went from $6.5 million to $6.8 million. The cost of doing business for the town increased by about $300,000 and were able to anticipate revenue with the PILOT program – none of which has hit yet but we were able to anticipate revenue from it at $250,000 so it took some real work for us to hone things down at another $50,000 to really balance things.”

“I voted against the introduction (and the budget itself) because the proposed budget increases expenses by $425,272.58 (6.6 percent) and increases the amount from taxes and PILOT fees by $258,930.09 (10.4 percent),” Bowen told The Jackson Times.

“While the $250,000 in PILOT fees by residents in the Lennar development have already been collected, this is the first time these funds have been used to balance our township budget.”

Bowen added, “rather than one-time budget fixes, we should control our expenses and invest the PILOT funds in long-term tax and PILOT fee relief; strengthen the Plumsted Municipal Utilities Authority (PMUA); redevelop Main Street; repave our roads and correct drainage problems; upgrade our recreation facilities and open spaces; increase our funding for the Plumsted Township Police Department, Plumsted Township Fire District #1, and Plumsted Township EMS Services.”

Cuozzo said funds were put into the budget for infrastructure. “We are putting $140,000 in capital outlay into the police officers’ budget for their two new vehicles and the new radio and over $23,000 will be applied directly to road paving and another $175,000 will go toward the sewer program.”

Gower went over some of the numbers with the budget that includes a .000 cent increase in the tax rate with the total municipal tax rate being $0.317. The average Plumsted home was valued at $281,705 last year. This year that total is $282,986.

The estimated average homeowner tax bill features 60.63% in school taxes at an estimated tax rate of 1.839 with estimated tax coming in at $5,204.11. The County percentage is 16.9% at .512 estimated tax rate ad $1,448.89. The township percentage is 10.41 at an estimated tax rate of .317 with an estimated tax of $897.07

The percentage from the fire district is 11.4 with an estimated tax rate of .345 and an estimated tax of $56.60. The total percent at 100% has an estimated tax rate of 3.033 and an estimated tax of $8,583.97

Committeeman Leonard Grilletto, who heads the finance committee said, “the municipal tax rate stayed the same.” He noted that Plumsted was more of a residential community than a commercial one.

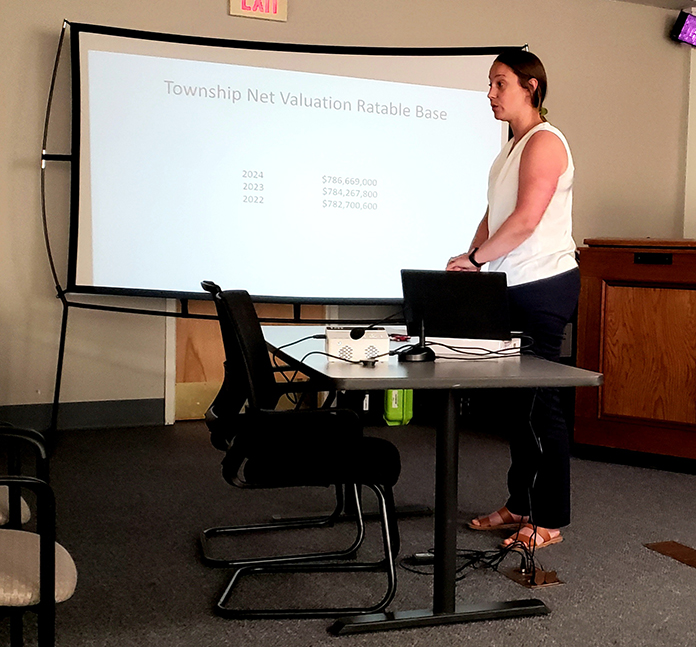

The township’s net valuation ratable base was $782,700,600 in 2022. In 2023 it was $784,267,800 and this year it is $786,669,000. Salaries jumped from $1,997,071 in 2023 to $2,107,905 this year.

“The MUA (Municipal Utilities Authority) and the Sewer Department has reached out to us. They have a $1.3 million budget and a $700,000 revenue stream which is an annual $600,000 deficit and the school (district) also has a large deficit and though it is not the purview of this Committee I think it is incumbent upon us to help them,” the mayor remarked.

He said there were requests made from the sewer department and from the school district “and I want the public to know that as a committee we are taking those things very seriously and we are going to consider those requests and to do everything we can to be a help to them.”

A public hearing on a budget amendment will be held during the July 11 committee meeting.