TRENTON – The former longtime head of the Ocean County Republican Party was sentenced to a year and a day in federal prison for financial crimes he committed over the past few years.

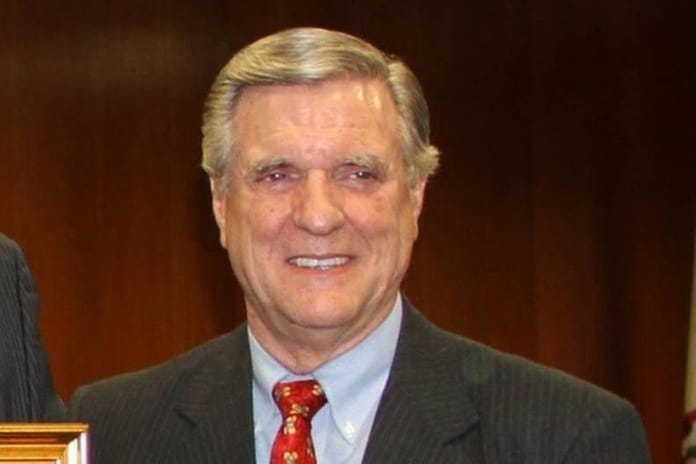

A pallid-looking George R. Gilmore apologized for his financial misdeeds. Some of his family and friends sobbed during and after the court proceedings.

Gilmore was not jailed on the morning of his sentencing hearing on Jan. 22. U.S. District Court Judge Anne E. Thompson gave him and Kevin H. Marino – his Chatham-based attorney – several weeks to file arguments on why an appeal should be granted.

He will serve his sentence at Fort Dix Federal Correctional Institution. Gilmore will also have to serve three years of probation once his sentence runs out. Thompson also ordered that the one-time party head will have to receive mental health treatment.

His attorney had declared this was part of a hoarding disorder. An expert on this was brought forward to testify, but the federal government did not want to hear this testimony in the case. Gilmore was to have a psychiatric evaluation. The results of that evaluation, or if it even took place, was unknown as of press time.

Thompson did not fine Gilmore for any of his offenses, but said he would end up paying “about a million a year” in contract penalties.

The Toms River resident had been previously indicted by a federal grand jury regarding his work as an attorney with his firm Gilmore & Monahan. This firm has since closed and his partner and employees were not charged.

Gilmore’s law firm did work for a number of towns, which dissolved their contracts with him. He also had to step down from being chairman of the county Republicans. Frank Holman took his place in a vote held May 15.

A press release from the U.S. Attorney’s office detailed the charges. As a partner and shareholder at Gilmore & Monahan, he was in control of the law firm’s financials. For tax quarters ending March 31, 2016 and June 30, 2016, the firm withheld tax payments from its employees’ checks, but Gilmore did not pay them in full to the IRS.

Additionally, he applied for a Uniform Residential Loan Application (URLA) to obtain refinancing of a mortgage loan for $1.5 million with a “cash out” provision that provided Gilmore would obtain cash from the loan on Nov. 21, 2014. On Jan. 22, 2015, he updated the application, failing to disclose outstanding 2013 tax liabilities and personal loans he got from other people. He had received $572,000 from the cash out portion of the loan.

The jury was not able to reach a decision on the charge of tax evasion for years 2013, 2014, and 2015, the court spokesman said. He was acquitted of two charges of filing false tax returns for calendar years 2013 and 2014.

The two counts of failing to collect, account for, and pay over payroll taxes each carry a maximum penalty of five years in prison, and a $250,000 fine, or twice the gross gain or loss from the offense. The count of loan application fraud carries a maximum penalty of 30 years in prison and a $1 million fine.

Instead of paying taxes, he had been spending a great deal on home remodeling and lavish decorations, reportedly on such things as a mammoth tusk and a statue of George Washington.

An Open Public Records Act request for the sentencing materials was not provided by the court by press time.

A press release from the U.S. Attorney’s office said First Assistant U.S. Attorney Rachael Honig credited a number of people for this investigation, including: special agents of IRS-Criminal Investigation, under the direction of Special Agent in Charge John R. Tafur, special agents with U.S. Attorney’s Office under the direction of Supervisory Special Agent Thomas Mahoney, and special agents of the FBI Red Bank Resident Agency, under the direction of Special Agent in Charge Gregory W. Ehrie in Newark.

The government is represented by Deputy U.S. Attorney Matthew J. Skahill; Assistant U.S. Attorney Jihee G. Suh of the U.S. Attorney’s Office Special Prosecutions Division; and Trial Attorney Thomas F. Koelbl of the U.S. Department of Justice – Tax Division.

– Chris Lundy contributed to this story.