HOWELL – It’s been anything but business as usual for Howell Township’s 2017 municipal budget, an agenda item that’s been in the works since October of last year.

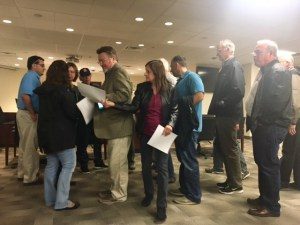

At a town council meeting on April 18, Mayor Theresa Berger, Deputy Mayor Robert Nicastro and Councilmembers Robert Walsh and Evelyn O’Donnell listened to a town hall packed with residents deliver a very clear message – the taxes are too high.

Residents were upset over a 4.63 percent increase in the amount of the budget to be raised by taxpayers this year, which at that time equated to $26,585,000. Many of them spoke during the public hearing portion of the meeting to tell council members they were already fed up with paying $16-, $17- and $18,000 in taxes on their homes every year.

Residents also feel that it’s unfair their houses are being assessed at fair market value every year, as it only adds to the problem. They urged the mayor and council to “get the pencil sharp and trim this budget.”

One resident, a retired police officer from New York, said that when he first moved to Howell, his taxes were $9,000. Now, they’re $17,000. He said there are seven houses on his block. In three of them, people just walked away and left them empty. Despite his appreciation for the township and its suburban feel, the taxes have gone up, but his pension remains the same.

It seems like the message may have gotten through, as Mayor Berger and councilmembers decided not to entertain a motion to adopt the 2017 budget as introduced at the April 18 meeting. An increase to the 2017 temporary budget took effect, which bought the township some time to figure things out.

Officials advised residents that an estimated $913,000 would need to be cut from the budget in order to bring the tax levy increase to zero. But where would the money come from?

Aside from the Senior Center, there were few discretionary services left for Howell cut, seeing as the Recreation Department and Youth and Family Services have already made their way out the door. Officials feared that once you start cutting into departments, overtime and fees for outside professionals would increase, creating an even worse financial scenario.

Budget Passes With Minimal Cuts

Another special meeting was called to discuss the budget on April 27, and after over an hour of public hearing from residents on the topic, the council finally voted on an amended $47,767,000 budget that passed – with a sole no vote coming from Mayor Berger.

Officials managed to cut an additional $246,443 from the portion of the budget to be raised by taxpayers. This did not bring the tax levy to zero, but offered taxpayers some minor relief. The budget will now be supported by $26,338,557 in taxes, which is a 3.66 percent increase over last year’s tax levy.

“I know some of the things we’re cutting tonight, they’re going to come back to bite us a little bit, they really are,” said Councilman Walsh.

Mayor Berger also voted no to a resolution that offered these cuts, to which Councilwoman O’Donnell pointed out, “You voted no to your own cuts.” Berger replied back that they were not enough. At the April 18 meeting, she told councilmembers and residents that she had presented $600,000 in her own cuts. When a resident asked about what happened to the mayor’s cuts, Walsh said that they were good ideas, but had either already been cut, or were unable to be cut.

Rising Home Assessments – When Does It Stop?

Even though the municipal tax rate remained nearly the same, at 39.5 cents for every $100 of assessed property, the average home value in Howell Township rose to $332,528 – which is $14,359 higher than it was during the 2016 budget.

Based on that median home value, the average resident will be impacted $1,314 on their tax bill, an increase of approximately $45, which will vary based on each homeowner’s assessed value.

Adding to the issue are annual home reassessments, which, according to the Monmouth County Board of Taxation, Governor Christie initiated in tax year 2014 to ensure homeowners were paying their fair share of taxes and not unfairly paying more or less than they should for a decade or more. Monmouth County signed on to be the first in the state to take on this “cost saving” Assessment Demonstration Program.

This creates a situation where even though the tax rate remains the same, if a resident’s home assessment continues to rise, their taxes will go up regardless.

Resident Gary Wagman, who built his own home 17 years ago on six acres of property on West Farms Road, has paid property taxes as high as $24,000 a year. He appealed them down to $17,000 five years ago, but they are now back up to $22,000. He asked the mayor and councilmembers why the influx of new commercial development – Lowe’s, Target, Xscape Theatres – doesn’t help the situation.

“I just don’t understand why that revenue isn’t helping our budget. All of our taxes here, every year, go up. Not down, or stay the same. When’s it stop? That’s all I’m asking.”

Looking Ahead, Next Year’s Budget

During the course of adopting the 2017 budget, the idea to put together a resident budget council arose, ideally when 2018 budget discussions commence in the November timeframe.

Councilman Walsh encouraged the idea, telling residents at the April 27 meeting that they’d have to start going after big ticket items to really make a difference.

“We’re not going to be able to clip coupons and save a million, two million dollars,” he said.