BERKELEY – Parts of Berkeley Township are now designated Opportunity Zones that would lure businesses to invest in commercial projects.

The Opportunity Zone entices investors to pour their money into areas that need improvements with less risk. They are allowed to defer capital gains on earnings from those investments. The longer they invest, the better the deal is for them. If they maintain their investment for ten or more years, they are not subject to any additional capital gains tax on earnings in that zone.

“We could really use this advantage,” Mayor Carmen Amato said. “It’s another tool for investment.”

He said he hopes that the investors will build up the commercial areas of Route 9 to bring new jobs and expanded options for residents.

The Opportunity Zone doesn’t change the current zoning of the property, Amato clarified.

This is important to note since there are residential areas in the Opportunity Zones. The deal is available for private investors for already-existing commercial property.

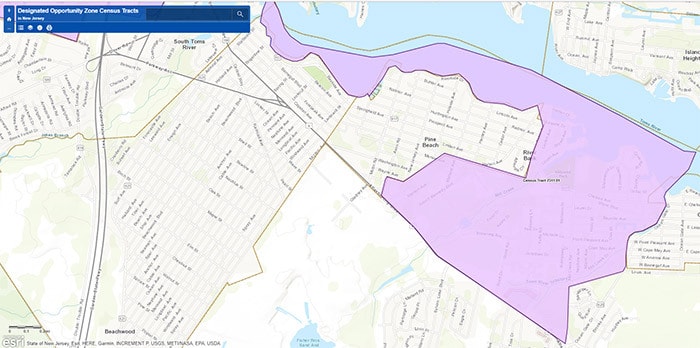

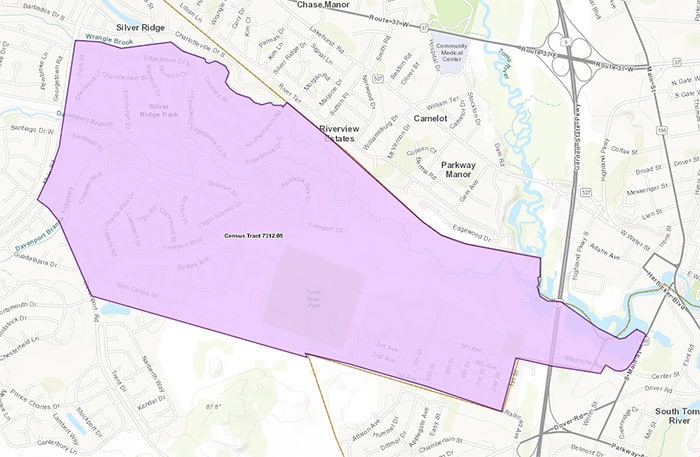

The first area in Berkeley is the Route 9 corridor on the east side only, from the border with Pine Beach, to the Mill Creek section, which cuts off just before Ocean Gate. The other area includes Manitou Park and some of the senior community east of Mule Road.

Initially, the state had designated another senior community area, near the western border of the town that included Jamaica Boulevard. Amato and his administration made a request to change it to the Route 9 tract and their suggestion was approved.

“This area remains an area in need of redevelopment and investment to spur economic recovery and growth for Berkeley and the neighboring towns,” he had written to the state.

There were also three tracts in Manchester and six in Lakewood that were identified.

The Opportunity Zones program was part of the 2017 federal Tax Cuts and Jobs Act. The State Department of Community Affairs submitted recommendations for Opportunity Zones in towns throughout New Jersey to the United States Department of the Treasury for approval. The eligible Opportunity Zones are census tracts with a poverty rate of 20 percent, or a median family income up to 80 percent of the area median. The state was allowed to submit up to 25 percent of all census tracts. The approvals came less than three weeks later. All 169 recommendations were approved, amounting to at least one zone in every county, according to a press release from Gov. Phil Murphy’s office.

Reaction To The Program

Critics of the program point out that it helps first and foremost investors, and that there’s no guarantee that the benefits that investors get will be used to stimulate jobs locally. There is also a concern that the investors could change the character of certain areas and push out existing businesses.

However, local policy makers lauded the zones.

“New Jersey is committed to using every tool at our disposal to develop our communities and grow our economy,” Governor Murphy said in a press release. “This program provides real opportunity for our state that has the potential to create significant, long-term economic development in the communities that need it the most.”

Choosing these spots was the result of a number of state departments, including Sen. Cory Booker’s (D-NJ) office, and roundtables with various government officials and local mayors, the release stated. The goal was to spread out the zones so that every county got at least one.

“Every community should have access to the resources needed to realize its full entrepreneurial potential,” said Senator Cory Booker in a press release. “But barriers stand between too many of our communities and the capital needed to generate economic growth and opportunity. I’m proud our governor is utilizing this tool to help drive investment across our state, and I look forward to continuing our partnership to create jobs, increase wages, and support economic growth in every corner of New Jersey.”

Congressman Tom MacArthur (R-3rd) applauded the Opportunity Zone designation of multiple areas within towns in his district, which includes Berkeley.

“By encouraging long-term investment in these areas, we will revitalize neighborhoods right here in South Jersey,” he said. “I supported the Tax Cuts and Jobs Act because of the benefits it would provide our state, and the Opportunity Zone designations, along with families being able to keep more of their hard earned money, is another example of how the tax cut legislation is benefiting South Jersey.”

New Jersey Future, a nonprofit that promotes sensible growth and redevelopment, praised the quick approval of these zones.

“Our analysis largely suggests that these Opportunity Zone tracts are places where strategic investments can serve as a strong catalyst for future economic growth,” New Jersey Future Executive Director Peter Kasabach said in a press release. “They have the right combination of good location and durable assets on which to build, and they show the potential to provide the return that Opportunity Fund investors will be seeking.”

New Jersey Future studied a number of factors, including changes in population, median rent, and median income between 2011 and 2016, in the Opportunity Zones when compared to other areas of the state. The group also looked at transportation and other information to determine if the areas have a “town center” feel.